Automating M&A work for lawyers

Your AI-powered associate with endless capacity

Trusted by leading legal accelerators

Your AI-powered associate with endless capacity

Trusted by leading legal accelerators

Casper is for corporate legal teams, trained by experienced lawyers on real M&A and VC deals. Our deal workflows have been tested and proven on actual transactions, delivering more detail, more accuracy and deeper reasoning from real market perspectives.

Trained on actual transactions by practising lawyers

Real deal requirements automated for your team

All features adapt to your client's risk profile

| Category | Files | Risk |

|---|---|---|

| Financial | 127 | |

| Legal | 89 | |

| Commercial | 43 | |

| Tax | 31 | |

| HR | 22 |

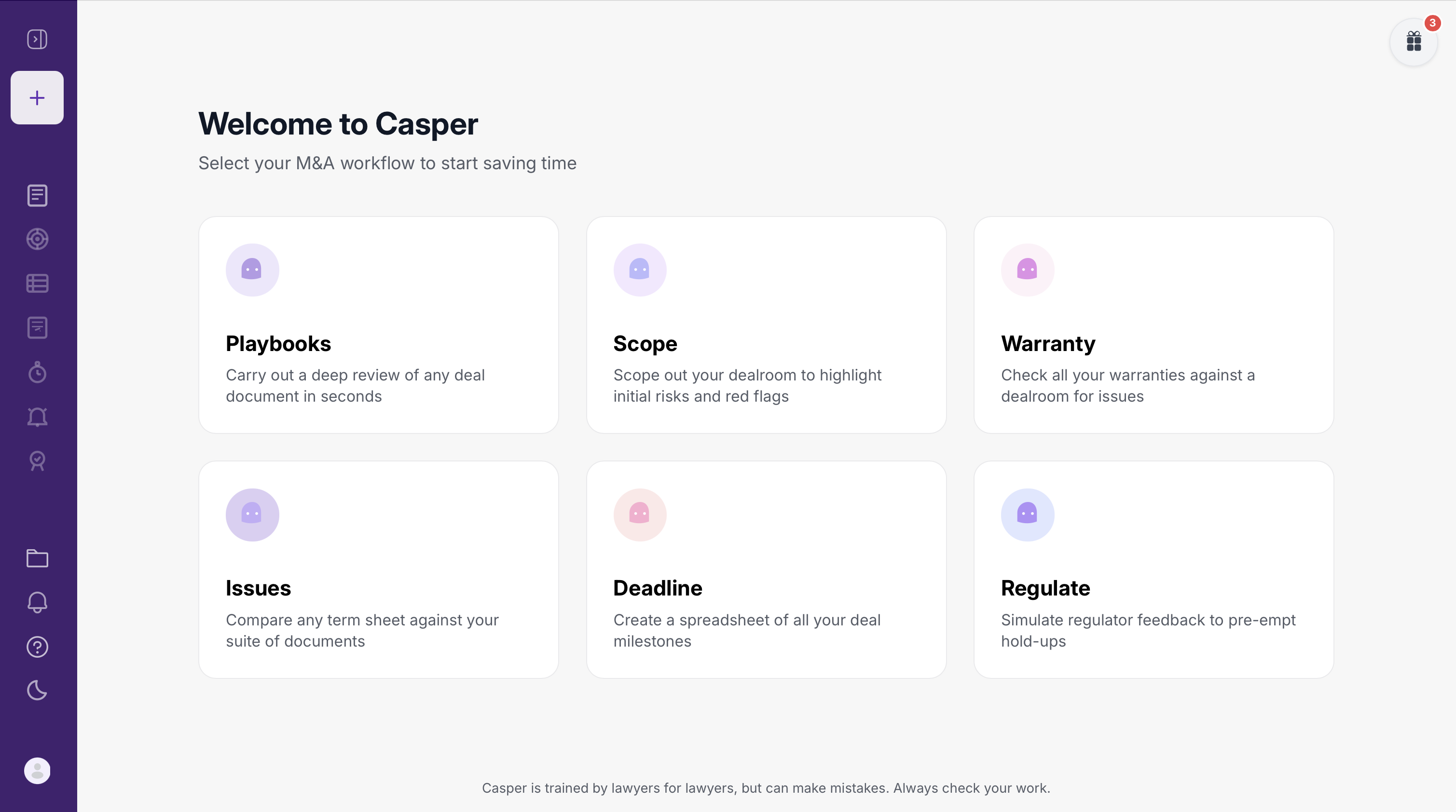

Initial due diligence on any dataroom, helping you quote and identify resource bottlenecks faster

Learn moreBuilt by practising M&A lawyers, run our pre-built playbooks across any sale document that adapt to your client's risk profile

Learn moreThe financial statements fairly present in all material respects the financial position of the Company and have been prepared in accordance with GAAP consistently applied.

Check warranty wording against any deal room and pre-built market standards

Learn moreIdentify likely regulator comments on any part of your deal in advance

Learn morePurpose-built for M&A workflows with proven results across real transactions

Streamlined workflows from term sheet to closing with automated analysis and instant reporting

AI trained on real M&A transactions by practising lawyers delivering unmatched precision

ISO 27001 compliant with end-to-end encryption and zero AI training on client data

Replace junior associate work with AI efficiency while maintaining partner-level oversight

No prompting, no training required. Purpose-built workflows that work straight out of the box

Identify potential issues and regulatory concerns before they become deal-breaking problems

Early thoughts from our private beta in select top law firms

Be among the first to experience Casper with exclusive pre-access

We'll let you know when access is opened up to early users

Everything you need to know about Casper and early access.

We're currently in private beta with select law firms. Early access will begin rolling out in Q3 2025, with waitlist members getting priority access. Full availability is planned for Q4 2025.

Casper works with all standard M&A documents including purchase agreements, disclosure letters, due diligence reports, term sheets, and ancillary documents. Our AI has been specifically trained on real M&A transactions across multiple jurisdictions.

Casper integrates seamlessly with your existing document management systems and can work with documents in their native formats. No need to change your current processes – Casper enhances what you're already doing.

Security is our top priority. All data is encrypted in transit and at rest, with enterprise-grade security measures. We maintain ISO 27001 compliance and offer on-premises deployment options for the most sensitive transactions.

Absolutely. Casper can be trained on your firm's precedents and adapted to your specific deal types, risk preferences, and client requirements. We work closely with each firm to ensure optimal performance.

Early access members get full access to all Casper features, priority support, direct input on product development, and exclusive training sessions with our team. Plus, you'll lock in special early-bird pricing.